Making investment advice delivery easy

and accessible to anyone, anytime, anywhere

Powering enterprises' digital transformation with the next generation of hybrid AI investment advisory platform.

Contact Us

About Us

Reinventing the way investment advisors

Helping personal and private banking business units realize their corporate digital advisory strategy, keeping a personal client relationship through high-end, accessible and personalized tailored investment advisory service delivered directly to their smartphones.

Our solution allows investment professionals to unlock and convert their investment insights into clear actionable advice which can then be easily shared on a large scale with existing and new investors.

Trusted partnerships that make your client’s investment grow through

PROACTIVE INVESTMENT ADVISORY SERVICES

Processing over

$10B in AUM/AUA & growing

Providing digital advisory services to over

50,000 INVESTORS & growing

What we do

Nummularii provides an AI based advisory platform that

scales and automates investment advisory services

Our platform digitizes the entire investment advice delivery life cycle:

Investment made simple, actionable and cost-effective

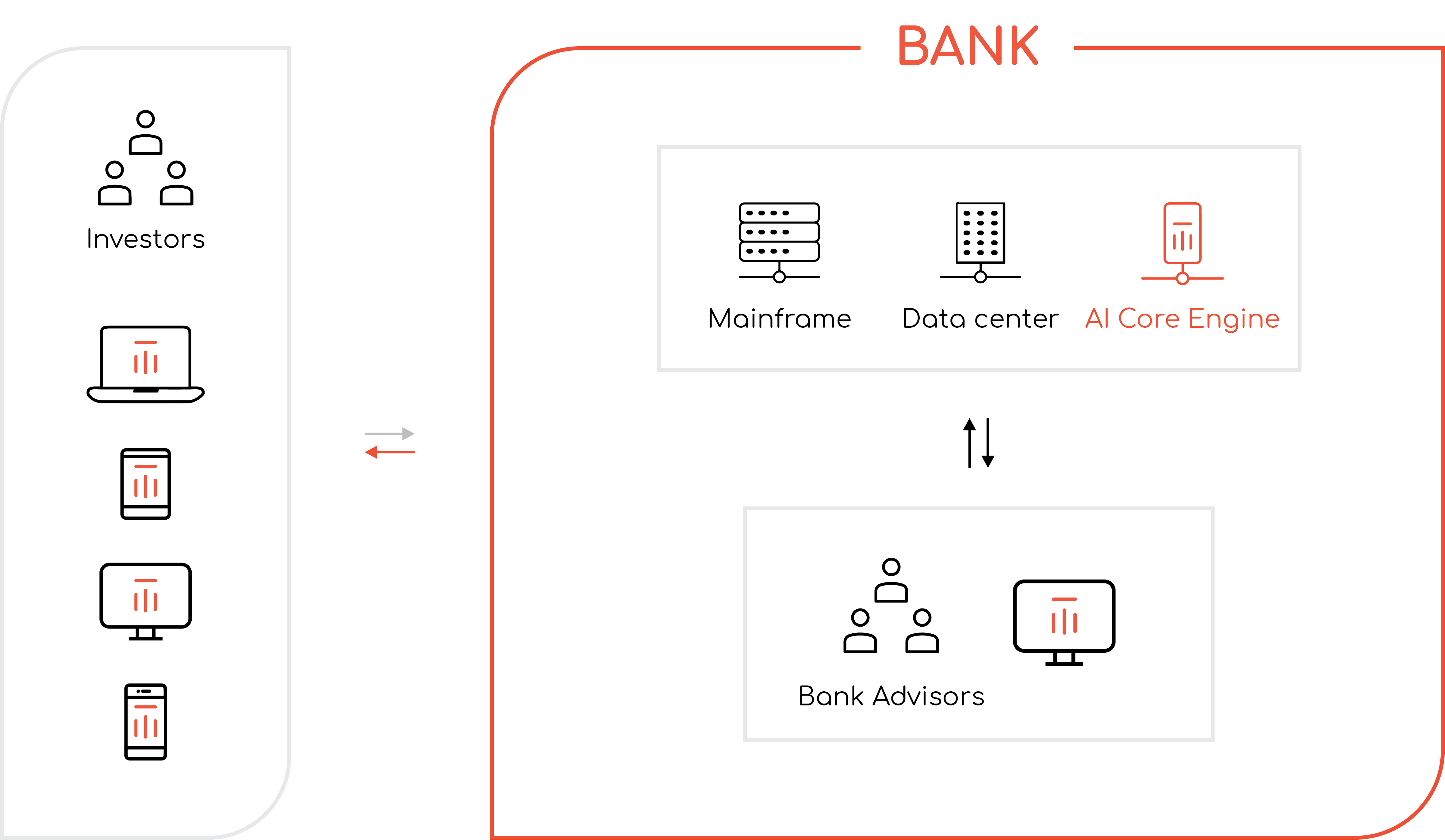

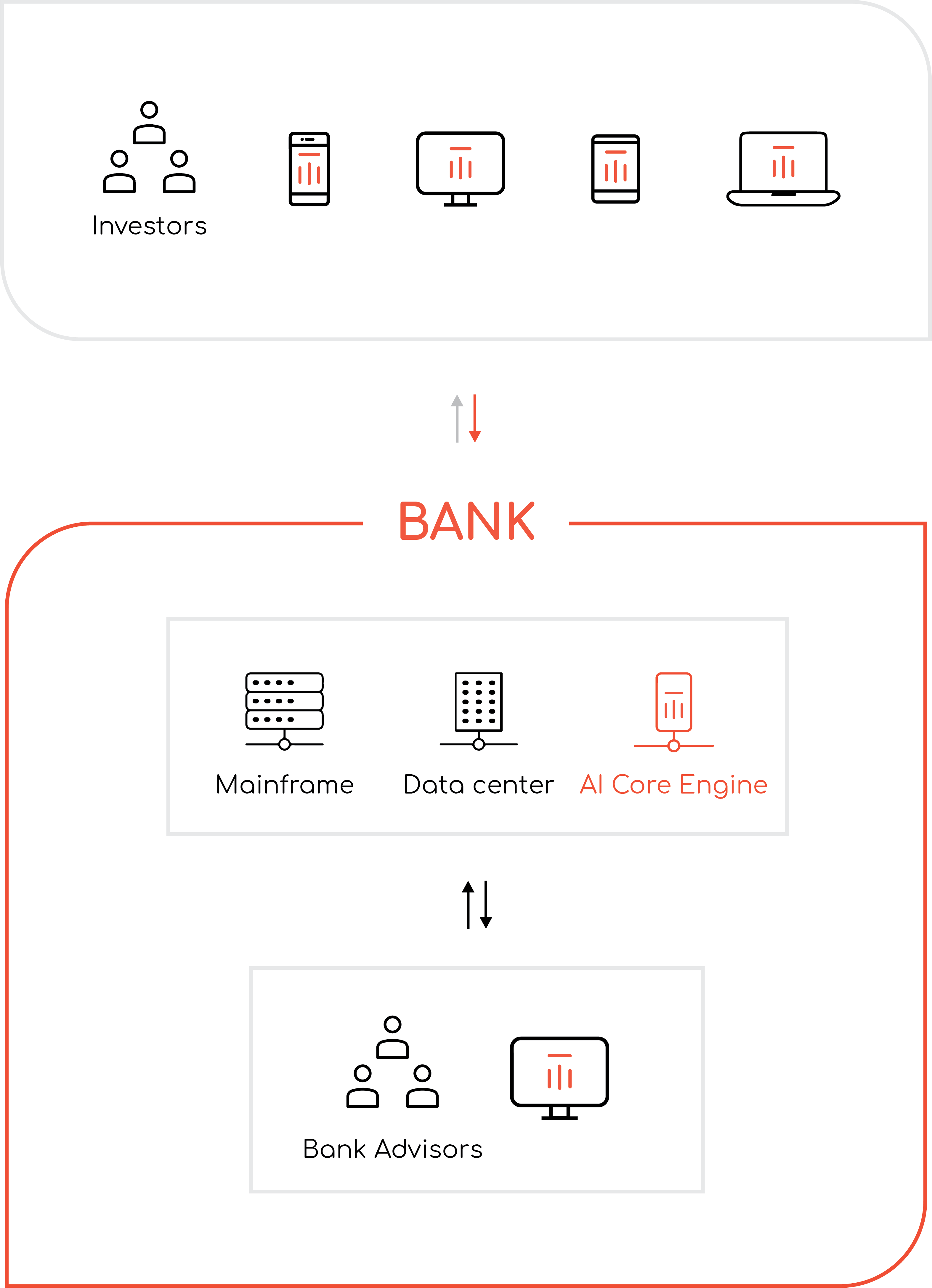

How it works

Instead of serving one client at a time, each advisor can now provide customized advice and send it simultaneously to unlimited different investors with portfolio variants across all strategy profiles.

Investors receive personalized, actionable, real-time advice directly to their smartphones, allowing them to instantly act upon the advice through their banking app.

Our offering

For enterprises, banks and investment advisory firms

Advisory solutions that fit your enterprise digital strategy

We understand that banks and advisory firms differ from one another in size, digital strategy, organization procedures and global location, with different requirements for each. Our innovative end-to-end platform is designed to support different B2B clients’ needs, enabling our enterprise clients to customize it to their investment methodologies and their investors’ goals so they can distinguish their unique digital offering from those of others.

The next generation of hybrid B2B advisory platforms

Most banks and their investment clients find that neither the fully automated robo-advisors nor the existing hybrid ones fit their specific needs. Rapid market changes require instant response – the very downfall of pure robo and classic hybrid robo platforms. Market events can have long or short-term impacts, each influencing advisor recommendations. nummularii’s advanced AI based core and dedicated user interfaces allow advisors to convert these recommendation into actionable, real-time advice, simultaneously transmitted to all client smartphones.

Large scale advisory service for non-discretionary

Investment advisors face a huge challenge when working on a large-scale, having investors with different goals and preferences take individual action per investment advice. These services require repetitive manual procedures that hinder business growth. nummularii allows banks and each of their advisors to simultaneously deliver personalized advice to multiple portfolios across different investment strategies, while maintaining the highest fiduciary standards. Clients then act upon the advice delivered directly to their smartphones, using their mobile banking app to study, simulate, decide and execute the advice at the push of a button

Seamless user experience

White-label UI provided through API-based architecture. Configure features and personalize the system per organization, contingent on company policies and needs.

For investors

Bridging the advisory gap

Whether millennial, emerging/mass affluent or even a HNW, investors differ from one another in age, knowledge, availability and portfolio size. What they do share, however, is a desire for transparent, affordable, tailored on-demand and simple to understand investment advice given by a human expert they can trust. nummularii’s solution enables banks and similar enterprises to diversify their digital offering and deliver superior quality advisory services to different client segments.

Personal, simple, single experience

By eliminating the current friction we release investors from the burden of active engagement, providing them instead with high quality tailored investment advices from their trusted advisor anywhere anytime, delivered directly to their mobile banking app.

Insures the highest fiduciary standards

nummularii enables the simultaneous delivery and enforcement of digital advisory services on a large scale, while providing each investor individual preferences, goals and risk tolerance along with the bank specific rules and methodologies.

Access to proactive advisory service

Unlike typical robo-advisors, nummularii enables its B2B clients to give all of its clients (portfolio owners) access to personalized active and passive investment advisory services, without forcing them to pick fixed allocated managed portfolios.

Solution

Rapid deployment

White label

Open API

Customizable core

On Premise

Our

Technology

White labeled, open API architecture for simple integration

Our API-based platform allows for simple integration with all types of third party technologies and service providers. nummularii integrates into the existing IT infrastructure, embedding functionality into existing tools and application used by analysts, advisors and investors. Off-the-shelf nummularii modules and user-interfaces are also available.

Scalable, high-performance platform

nummularii’s robust platform enables banks and similar enterprises to handle masses of concurrent investors, advisors and other users with varying data input/output loads across all interfaces and channels.

Agility and security compliance

Our secured on-site solution guarantee that bank IT experts maintain total control over the all solution security aspects, allowing them to apply the same rigid corporate security protocols within their existing backend, eliminating the need to approve new external interface protocols. nummularii also offers advanced tailored architectures that support special requirements for legacy IT or transitional stages, so organization won’t need to give up on innovation

AI enhancement capabilities

We apply a layer of AI capabilities, such as learning processes and NLP on top of core functionality to leverage and enhance the personalization process throughout the engagement process.

Flexible assets coverage

The flexible nummularii solutions allow banks and their investment experts to work across multiple asset types including government/corporate bonds, mutual funds, ETFs, stocks and more while having the ability to control and change this coverage at any given time. We have the ability to break down each and every single security type into different risk elements and ensure the portfolio risk accuracy.

Extended Solution ecosystem

While nummularii’s main offering focuses on personalizing and delivering investment advice, we provide our B2B customers with optional integrative modules such as reporting, compliance documentation, BI analysis & monitoring, administration and more.

Contact us

Exploring collaboration and partnership with nummularii

Ahad Ha’Am st 54, Tel Aviv-Yafo, 6579402 Israel

Gain insight

through Pilot and POC

POC can be carry out with zero integration or exporting of confidential enterprise data. Our POC/Pilot dedicated sandbox allows us to recreate exact bank advisory environments and simulate the same investment methodologies services you wish to test.

CONTACT US TO LEARN MORE